Are you tired of being denied for loans, paying sky-high interest rates, or watching your financial dreams slip away because of credit issues? If you're a North Carolina resident struggling with poor credit, you're not alone: and more importantly, you're not stuck. Your credit score doesn't have to define your financial future, and with the right approach and professional support, you can take control of your credit situation today.

Whether you're in Charlotte, Raleigh, Greensboro, or any corner of the Tar Heel State, credit problems affect thousands of North Carolinians every day. But here's the empowering truth: most credit issues can be resolved with the right strategy, persistence, and expert guidance.

Understanding Credit Challenges in North Carolina

The average North Carolina resident carries nearly $5,000 in credit card debt, creating significant barriers to homeownership, vehicle financing, and even rental applications in competitive markets like Research Triangle Park or downtown Charlotte. But debt isn't the only culprit damaging your credit score.

Many North Carolinians face these common credit reporting errors:

- Medical bills from hospital visits or emergency care that were incorrectly reported

- Student loan complications from the state's numerous universities and colleges

- Outdated collection accounts that should have been removed years ago

- Duplicate accounts showing the same debt multiple times

- Inaccurate payment histories that don't reflect your actual payment behavior

- Identity theft or mixed credit files from someone with a similar name

Do any of these sound familiar? If so, you have legal rights to dispute these inaccuracies, and taking action can dramatically improve your credit score in a matter of months.

How Credit Repair Actually Works

Credit repair isn't magic: it's a systematic process based on your legal rights under the Fair Credit Reporting Act. Here's how professional credit repair works to your advantage:

Step 1: Comprehensive Credit Analysis

Professional credit repair specialists obtain your reports from all three major bureaus (Experian, Equifax, and TransUnion) and conduct a thorough review. They identify not just obvious errors, but subtle inaccuracies that you might miss, such as incorrect account statuses, wrong dates, or reporting violations.

Step 2: Strategic Dispute Process

Rather than firing off generic dispute letters, experienced professionals craft targeted challenges based on specific violations of credit reporting laws. They know which arguments work best for different types of errors and how to navigate the complex dispute process effectively.

Step 3: Creditor Negotiations

Sometimes the issue isn't with the credit bureau: it's with the original creditor. Professional credit repair services can negotiate directly with creditors to remove negative items, arrange payment plans, or settle accounts in ways that minimize credit damage.

Step 4: Ongoing Monitoring and Follow-Up

Credit bureaus have 30 days to investigate disputes, but the process doesn't end there. Professional services track responses, file additional disputes when necessary, and ensure that removed items don't mysteriously reappear on your reports.

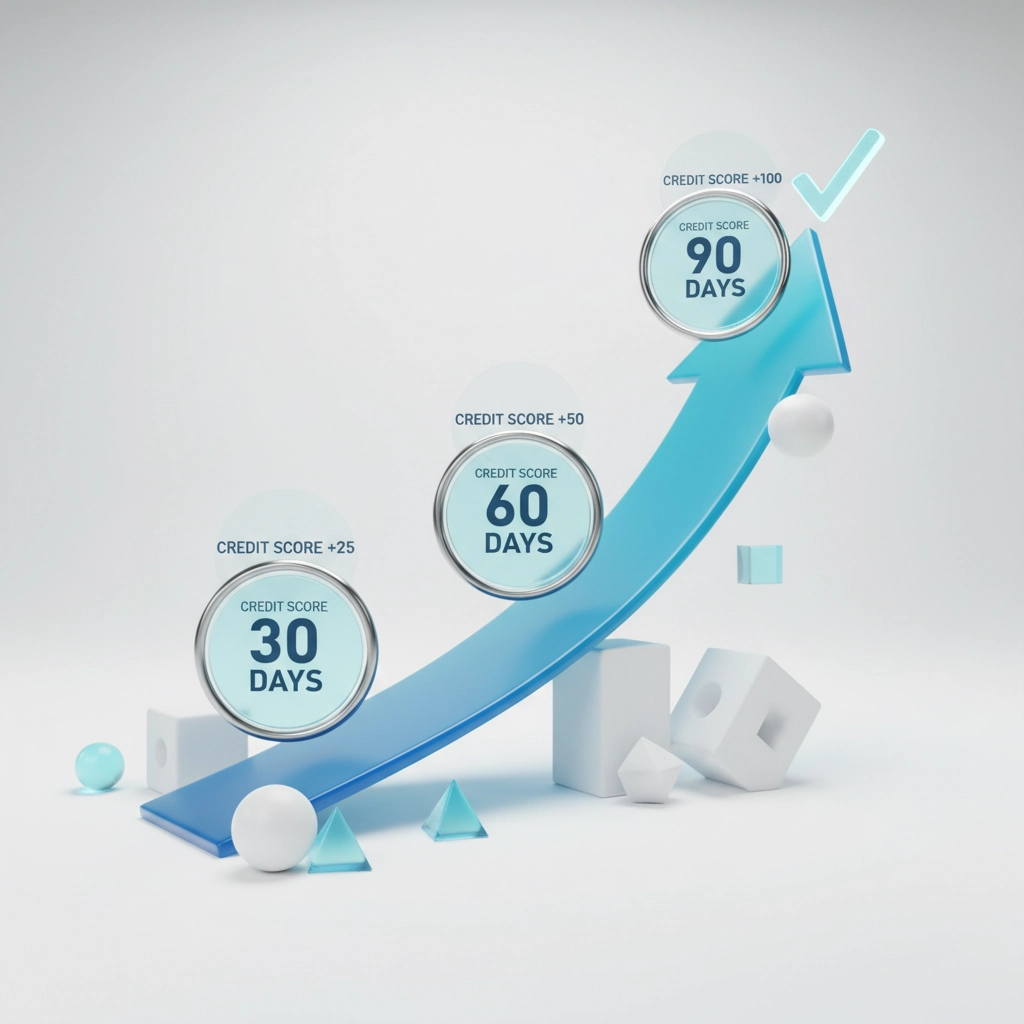

What Timeline Should You Expect?

Let's be realistic about expectations while staying optimistic about results. Most credit repair cases see meaningful improvements within 30 to 90 days, with complex cases taking up to six months. The timeline depends on factors like:

- How many inaccuracies appear on your reports

- The types of negative items you're disputing

- How responsive creditors and bureaus are to disputes

- Whether you need negotiations with original creditors

Remember, credit repair is a marathon, not a sprint: but every month of progress gets you closer to your financial goals.

Chrome Haris Credit Repair: Your North Carolina Credit Solution

At Chrome Haris Credit Repair, we understand the unique financial challenges facing North Carolina residents. Our comprehensive approach goes beyond basic credit repair to address the root causes of your financial stress.

Our Credit Repair Services Include:

- Thorough analysis of all three credit reports

- Strategic dispute filing for inaccurate, outdated, or unverifiable items

- Direct creditor negotiations and settlement assistance

- Ongoing credit monitoring and maintenance guidance

- Personalized strategies for building positive credit history

Specialized Business Solutions

If you're a North Carolina business owner struggling with cash flow or problematic merchant cash advances (MCAs), we offer specialized restructuring services that can save you up to 70% on existing agreements while providing more flexible repayment terms. These solutions can quickly resolve cash flow problems that might otherwise damage your personal or business credit.

Our Guarantee to You

We stand behind our work with a money-back guarantee and transparent flat-fee pricing. No hidden costs, no surprise charges: just straightforward service designed to get results.

Taking Action: Your Rights and Next Steps

Here's what you need to know about moving forward with credit repair in North Carolina:

You Have Legal Rights

The Fair Credit Reporting Act gives you the right to dispute any item on your credit report that you believe is inaccurate, incomplete, or unverifiable. Credit bureaus must investigate your disputes and remove items they cannot verify.

DIY vs. Professional Help

While you can dispute credit items yourself, professional credit repair services bring expertise, persistence, and industry knowledge that dramatically improves your success rate. They know which strategies work, how to navigate complex bureaucracies, and when to escalate disputes.

Warning Signs to Address Immediately

Don't wait if you're experiencing:

- Loan denials or extremely high interest rates

- Difficulty securing rental housing

- Problems with employment background checks

- Stress and anxiety about your financial situation

The longer negative items remain on your credit reports, the more opportunities you miss and the more money you potentially lose to high interest rates.

Ready to Transform Your Credit?

Your credit score is not a permanent sentence: it's a number that can change with the right actions and professional support. Thousands of North Carolina residents have successfully rebuilt their credit, secured better loan terms, purchased homes, and achieved their financial goals.

The question isn't whether you can improve your credit: it's whether you're ready to take action today.

Start Your Credit Transformation

Chrome Haris Credit Repair offers free credit evaluations to North Carolina residents. During this consultation, you'll discover:

- Specific items damaging your credit scores

- Your realistic timeline for improvement

- A personalized action plan for your situation

- How much money better credit could save you annually

Contact Chrome Haris Credit Repair today and take the first step toward financial freedom. Visit https://creditdispute911.com for your free evaluation, or call to speak with a credit repair specialist who understands the unique challenges facing North Carolina residents.

Don't let poor credit control your life another day. You have the power to change your financial future, and we have the expertise to guide you there. Your journey to better credit starts with a single decision; the decision to take action now.

Zero hassle. Maximum results. Your financial future starts today.

#NorthCarolinaCreditRepair #FixMyCreditNC #CreditDispute #CharlotteCreditHelp #CreditRepair