Living in New York comes with unique financial challenges. From sky-high rent in Manhattan to competitive business environments across the state, your credit score can make or break your financial future. Whether you're trying to secure a mortgage in Brooklyn, finance a business in Buffalo, or simply get better interest rates on Long Island, having damaged credit feels like carrying around a financial anchor.

But here's the truth: you have more control over your credit situation than you think. With the right strategy and expert support, you can transform your credit profile and unlock the financial opportunities you deserve.

Why Your Credit Score Matters More in New York

New York's cost of living demands financial flexibility. Landlords scrutinize credit scores before approving leases. Lenders examine your credit history before approving business loans. Even employers in competitive NYC markets sometimes check credit as part of their hiring process.

A poor credit score doesn't just cost you money: it costs you opportunities. Higher interest rates on loans, security deposits for utilities, and limited housing options all stem from damaged credit. For New York families and business owners, these barriers can feel insurmountable.

The good news? These barriers are temporary if you take action.

What Damages Your Credit (And How to Fix It)

Understanding what's hurting your credit is the first step toward repair. Common issues we see with New York clients include:

Late or Missed Payments: Even one 30-day late payment can drop your score significantly. If you've struggled with payment timing due to irregular income or cash flow issues, this damage compounds quickly.

High Credit Utilization: Using more than 30% of your available credit sends red flags to lenders. In expensive markets like New York, it's easy to max out cards just covering basic expenses.

Collections and Charge-offs: Medical bills, old utility accounts, or defaulted loans can haunt your credit report for years.

Inaccurate Information: Credit bureaus make mistakes. Wrong account details, identity mix-ups, or outdated information can unfairly damage your score.

Business Credit Issues: For entrepreneurs, personal and business credit often intertwine, creating complex repair challenges.

Here's what you need to know: every single one of these issues can be addressed with the right approach.

The Chrome Haris Credit Repair Difference

At Chrome Haris Credit Repair, we don't believe in one-size-fits-all solutions. New York residents face unique financial pressures, and your credit repair strategy should reflect that reality.

Our Proven Process

Comprehensive Credit Analysis: We examine all three credit bureaus (Experian, Equifax, and TransUnion) to identify every item affecting your score. This isn't just about obvious negatives: we look for subtle inaccuracies that other services miss.

Strategic Dispute Process: Using advanced dispute techniques and legal knowledge, we challenge inaccurate, outdated, or unverifiable items. Our team knows exactly how to communicate with credit bureaus and creditors to maximize removal success.

Ongoing Monitoring and Support: Credit repair isn't a one-time event. We provide continuous monitoring and updates, adjusting our strategy as your credit profile improves.

Custom Action Plans: Whether you're preparing to buy a home in Westchester or secure funding for a Manhattan startup, we tailor our approach to your specific goals and timeline.

Fast Results That Matter

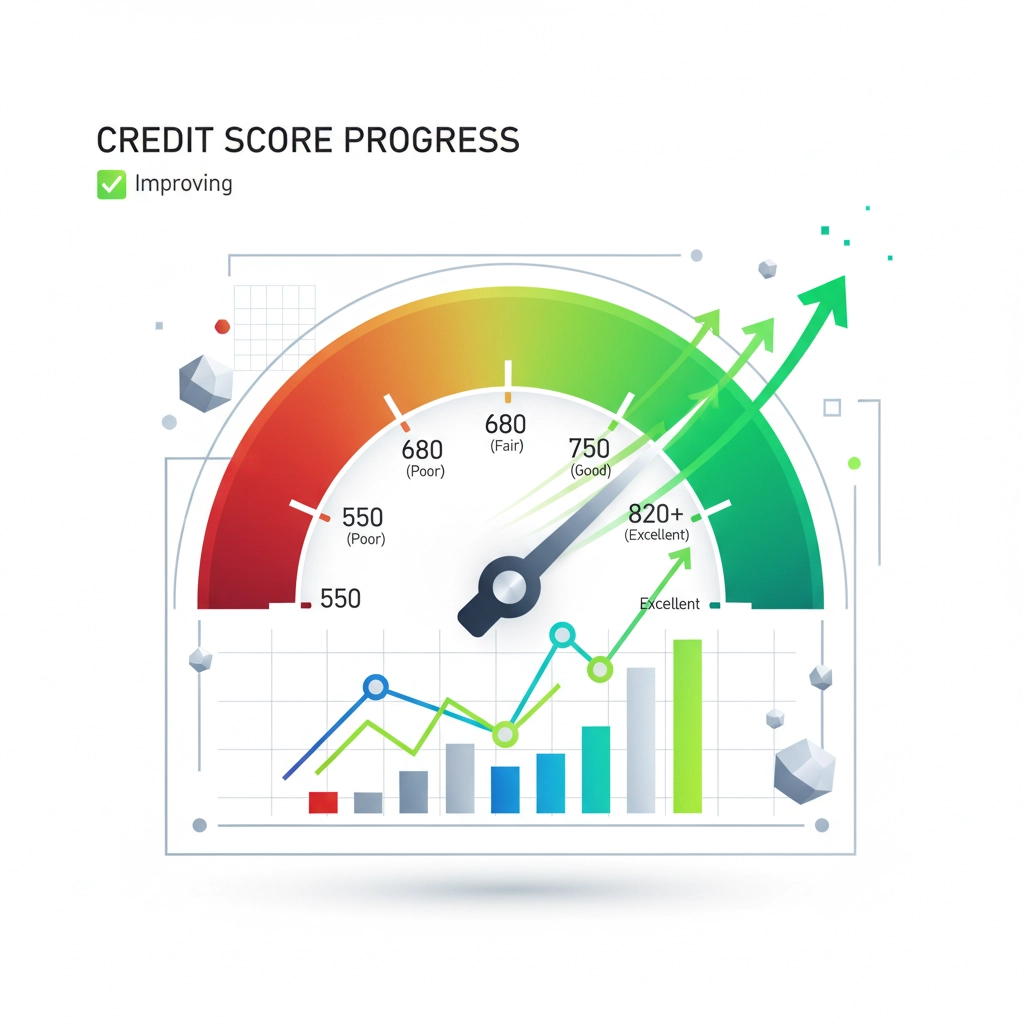

Most clients see initial improvements within 30-45 days. By month three, significant positive changes typically emerge. We've helped New York residents remove collections, late payments, charge-offs, and other negative items that were holding them back.

Real results from real clients: Credit score increases of 100-200 points aren't uncommon when we remove multiple inaccurate items and optimize credit utilization strategies.

MCA Restructuring: A Game-Changer for New York Businesses

If you're a business owner dealing with Merchant Cash Advances (MCAs), you know how these high-cost funding solutions can trap you in cycles of debt. The daily or weekly payment structures can crush cash flow, making it impossible to invest in growth or handle unexpected expenses.

Here's where we make a real difference: Our MCA restructuring services can reduce your payments by up to 70% and extend terms to 12-18 months. This isn't just debt consolidation: it's strategic financial restructuring that preserves your cash flow while addressing your obligations.

How MCA Restructuring Works

Assessment Phase: We analyze your current MCA agreements, payment schedules, and business cash flow patterns.

Negotiation Process: Using our relationships with MCA companies and legal expertise, we negotiate more favorable terms on your behalf.

Implementation: We structure new payment plans that align with your business's revenue cycles and growth projections.

Ongoing Support: We monitor the new arrangements and provide guidance to prevent future MCA dependency.

For New York business owners, this service alone can be the difference between closing doors and scaling operations. Your business deserves a chance to thrive, not just survive.

Why New Yorkers Choose Chrome Haris Credit Repair

Local Understanding: We understand New York's unique financial landscape. From co-op board requirements in NYC to business financing challenges upstate, we've seen it all.

Transparent Pricing: No hidden fees or surprise charges. Our flat-fee structure means you know exactly what you're investing upfront.

Money-Back Guarantee: We're so confident in our process that we back our services with a satisfaction guarantee. If we don't deliver results, you don't pay.

Fast Turnaround: We know time matters in New York's fast-paced environment. Our streamlined processes deliver results quickly without sacrificing quality.

Comprehensive Services: Beyond credit repair, we offer business financing solutions, MCA restructuring, and ongoing financial guidance.

Take Control of Your Financial Future Today

You've read about the problems, and you understand the solutions. Now it's time to take action. Every day you wait is another day of paying higher interest rates, facing loan rejections, or missing business opportunities.

Your Next Steps Are Simple

Step 1: Get your free credit evaluation at https://creditdispute911.com. This comprehensive analysis reveals exactly what's impacting your credit and what we can do about it.

Step 2: Schedule a consultation to discuss your specific situation and goals. Whether you need personal credit repair, business credit optimization, or MCA restructuring, we'll create a custom plan.

Step 3: Let our expert team get to work while you focus on your family and business. We handle the paperwork, communications, and follow-up.

The Cost of Waiting vs. The Value of Acting

Consider this: If damaged credit is costing you just $100 extra per month in higher interest rates and fees (a conservative estimate for most New Yorkers), that's $1,200 annually. Over five years, poor credit costs you $6,000 or more in unnecessary expenses.

Professional credit repair pays for itself by eliminating these ongoing costs and opening doors to better financial opportunities.

Ready to Transform Your Credit?

Your credit score isn't permanent. Your current financial challenges aren't insurmountable. You have the power to change your situation, and Chrome Haris Credit Repair has the expertise to guide you there.

Don't let another month pass while damaged credit costs you money and opportunities. Visit https://creditdispute911.com today for your free evaluation, or contact our team directly to discuss your specific needs.

Your financial freedom starts with a single decision. Make that decision today.

Chrome Haris Credit Repair serves individuals and businesses throughout New York State, from NYC and Long Island to Albany, Buffalo, Syracuse, and everywhere in between. We're committed to helping New Yorkers take control of their financial futures through expert credit repair and business restructuring services.

#NewYorkCreditRepair #FixMyCreditNY #CreditDispute #NYCCreditHelp #CreditRepair