Stop Wasting Time on DIY Credit Disputes: Try These 5 Free Evaluation Hacks Every New Jersey Resident Needs

Are you tired of spending hours trying to fix your credit on your own, only to see minimal results? You're not alone. Thousands of New Jersey residents waste countless hours attempting DIY credit disputes, often making costly mistakes that actually damage their credit further.

Here's the truth: while you can dispute credit errors yourself, there are smarter, more efficient ways to evaluate your credit situation before diving into the dispute process. These five free evaluation hacks will save you time, prevent costly mistakes, and give you the insight you need to make informed decisions about your credit repair journey.

Hack #1: Get Your Complete Credit Trinity Report (The Smart Way)

Most people think pulling one credit report is enough. That's your first mistake. Each of the three major credit bureaus: Equifax, Experian, and TransUnion: often contains different information about you. Missing errors on even one report can cost you points on your credit score.

Here's how New Jersey residents can access all three reports strategically:

The Annual Method: Visit AnnualCreditReport.com for your free annual reports from each bureau. But don't pull all three at once. Stagger them throughout the year: pull one every four months to monitor changes continuously.

The Emergency Method: If you've been denied credit, experienced identity theft, or are unemployed, you're entitled to additional free reports. New Jersey law provides extra protections, allowing residents to request reports after certain qualifying events.

The Weekly Method: During the pandemic, all three bureaus offer free weekly credit reports. Take advantage of this while it lasts to track your progress in real-time.

Pro Tip: Create a simple spreadsheet to track what appears on each bureau's report. You'll often find that negative items appear on one or two bureaus but not all three: this information is gold when planning your dispute strategy.

Hack #2: The 90-Second Error Detection System

Instead of reading your entire credit report line by line (which most people abandon halfway through), use this systematic approach to catch errors fast:

Personal Information Scan (15 seconds): Look only at your name, address, Social Security number, and date of birth. Incorrect personal information can cause legitimate accounts to appear as belonging to someone else.

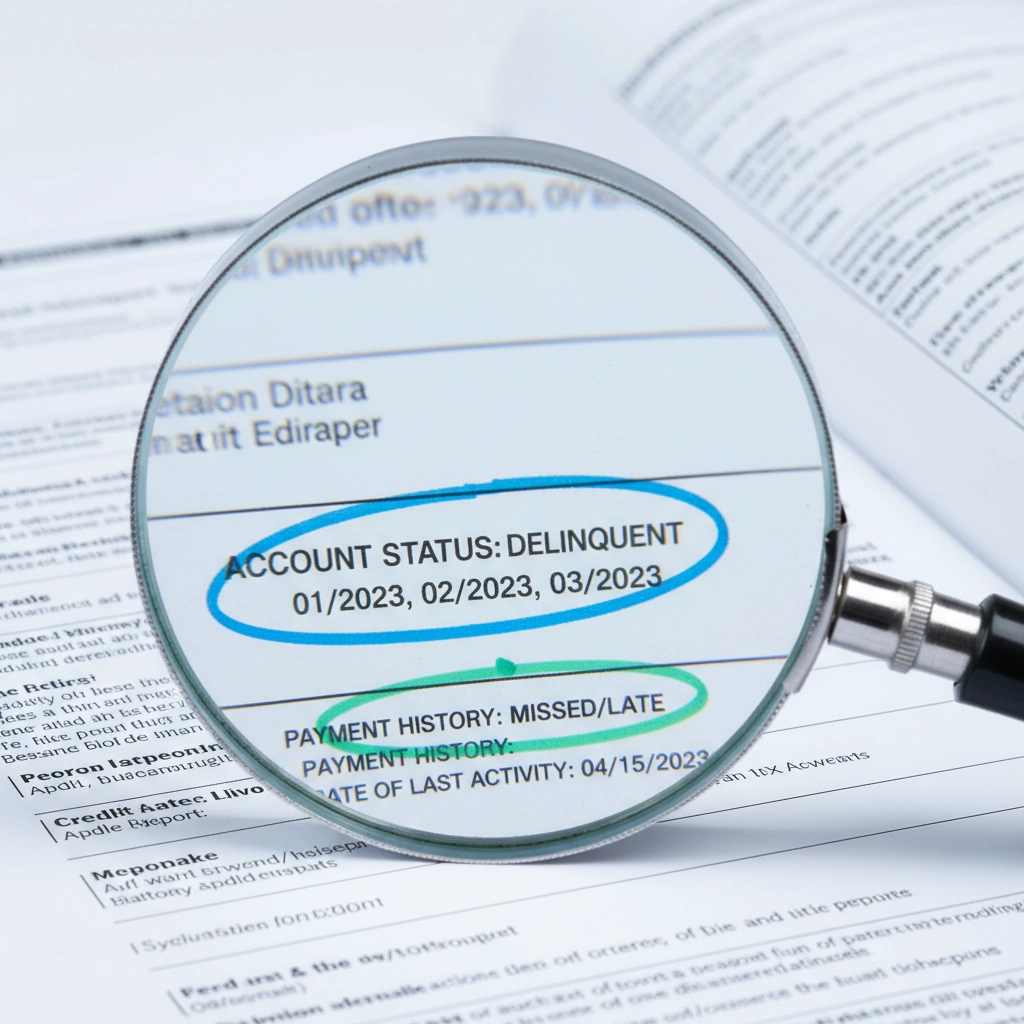

Account Status Quick Check (30 seconds): Scan the "Status" column for any accounts marked as "Paid as Agreed" that you know had late payments, or "Open" accounts you've closed. These are easy wins in disputes.

The Date Game (30 seconds): Check dates of first delinquency, last payment, and account opening. Creditors often report incorrect dates, which can make negative items appear newer than they are, keeping them on your report longer.

The Balance Blitz (15 seconds): Look for accounts showing balances when they should be zero, or accounts with balances that seem way off from what you remember.

This focused approach helps you identify the most impactful errors without getting overwhelmed by every detail on your report.

Hack #3: The Free Professional Opinion Trick

Before you start disputing anything, get a professional evaluation: without paying for it. Here's how:

Credit Union Consultations: Many New Jersey credit unions offer free credit consultations to members and potential members. They'll review your report and identify which items are worth disputing and which aren't.

Non-Profit Counseling: The National Foundation for Credit Counseling has certified counselors throughout New Jersey who provide free credit report reviews. They can spot errors you might miss and help prioritize which disputes to tackle first.

Bank Relationship Managers: If you have a relationship with a local bank, ask to speak with a lending specialist. They often provide informal credit consultations when you're considering applying for a loan.

The Chrome Haris Advantage: At Chrome Haris Credit Repair, we offer free credit evaluations to New Jersey residents. Our experts can identify not just obvious errors, but also technical violations of the Fair Credit Reporting Act that most people miss. Get your free evaluation here.

Hack #4: The Documentation Detective Method

Before filing any disputes, you need evidence. But most people waste time gathering the wrong documentation. Here's what actually matters:

Payment Records That Count: Bank statements showing payments made, not just payment confirmations. Creditors often claim they never received payments that were actually processed.

Account Closure Proof: For closed accounts still showing as open, you need official closure letters from creditors, not just your own records of calling to close accounts.

Identity Theft Evidence: If disputing fraudulent accounts, you need a police report and FTC Identity Theft Affidavit, not just your word that you didn't open the account.

Settlement Documentation: If you settled a debt, you need the written settlement agreement and proof of payment, not just cancelled checks.

The Paper Trail Rule: Every piece of evidence should have your name, the creditor's name, account number, and dates clearly visible. Blurry photos of statements won't cut it.

Hack #5: The Progress Tracking Power Play

Most DIY credit repair fails because people don't properly track their progress. Here's how to monitor your efforts effectively:

The 30-60-90 Day Calendar: Mark when you submitted each dispute and when you should expect responses. Credit bureaus have 30 days to investigate, but you should follow up if you haven't heard back within 35 days.

Score Tracking Strategy: Don't check your credit score daily: it won't change that fast and can become obsessive. Check monthly using free tools like Credit Karma or your credit card's free score feature.

The Results Journal: Keep a simple log of each dispute: what you disputed, when you submitted it, the bureau's response, and the outcome. This helps you avoid re-disputing items and shows patterns in bureau responses.

Celebration Milestones: Set small goals like "increase score by 20 points" or "remove 3 negative items" and celebrate when you hit them. Credit repair is a marathon, not a sprint.

When DIY Isn't Worth Your Time

Here's the honest truth about DIY credit disputes: they work, but they're incredibly time-consuming and often frustrating. If you're dealing with:

- Complex items like bankruptcies or foreclosures

- Multiple accounts with the same creditor

- Creditors who repeatedly verify inaccurate information

- Technical FCRA violations that require legal knowledge

Your time might be better spent working with professionals who handle these disputes daily.

Take Control of Your Credit Today

You have more power than you realize when it comes to your credit. These five evaluation hacks give you the foundation to make smart decisions about your credit repair approach: whether you choose to go it alone or work with professionals.

Remember, credit repair isn't just about disputing errors. It's about understanding your rights, having a strategic plan, and staying persistent. Every New Jersey resident deserves access to accurate credit reporting and fair treatment from creditors.

Ready to take the next step? Explore our comprehensive credit repair services or learn more about your consumer credit rights.

Your financial future is too important to leave to chance. Start with these free evaluation techniques, and remember: you don't have to navigate this journey alone.

Serving New Jersey Communities:

#NewarkCreditRepair #JerseyCityCreditRepair #PatersonCreditRepair #ElizabethCreditRepair #EdisonCreditRepair #Woodbridge Township CreditRepair #LakewoodCreditRepair #TomsDiverCreditRepair #HamiltonTownshipCreditRepair #TrentonCreditRepair #CliftonCreditRepair #CamdenCreditRepair #BrickTownshipCreditRepair #EastBrunswickCreditRepair #VinelandCreditRepair #BayonneCreditRepair #IrvingtonCreditRepair #ParamusCreditRepair #PassaicCreditRepair #UnionCityCreditRepair #HobokenCreditRepair #PlainfieldCreditRepair #WestNewYorkCreditRepair #WashingtonTownshipCreditRepair #NorthBergenCreditRepair #WeehawkenCreditRepair #KearyCreditRepair #EnglishedCreditRepair #OrangeCreditRepair #BergenfielCreditRepair #TeaNeckCreditRepair #BellnilleCreditRepair #UnionTownshipCreditRepair #PertAmboyCreditRepair #RaHhVayCreditRepair #NewBrunswickCreditRepair #LongBranchCreditRepair #BloomfieldCreditRepair #CherryHillCreditRepair #EvanstonCreditRepair #MontclairCreditRepair #MontsvilleCreditRepair #OldBridgeCreditRepair #GloucesterTownshipCreditRepair #EastOrangeCreditRepair #MiddletownTownshipCreditRepair #PiscatawayCreditRepair #WayNeCreditRepair #FairLawnCreditRepair #AsbreeParkCreditRepair #WillingboroCreditRepair #PricetonCreditRepair #WestMillordCreditRepair